Fsa Hsa Limits 2024

Fsa Hsa Limits 2024. Individuals can now contribute up to $4,150, while families can set aside $8,300. Healthcare flexible spending account and commuter irs limits.

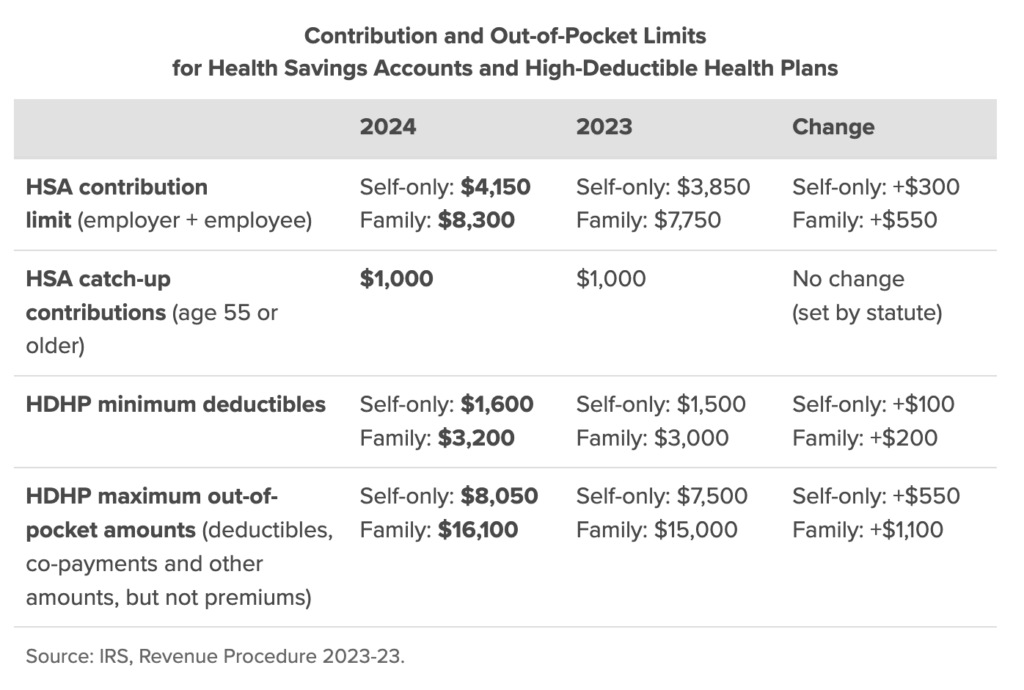

What to know about the ‘significant increase,’ says advisor. The health savings account (hsa) contribution limits increased from 2023 to 2024.

For 2024, The Limits Are $4,150 For Single Individuals And $8,300 For Families.

Those 55 and older can.

That Is A Lot More Money To Help.

But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Individuals Can Now Contribute Up To $4,150, While Families Can Set Aside $8,300.

Images References :

Source: isadorawivett.pages.dev

Source: isadorawivett.pages.dev

Affordable Health Care Limits 2024 Devin Feodora, The annual maximum hsa contribution for 2024 is: For 2024, there is a $150 increase to the contribution limit for these accounts.

Source: donicaqterrie.pages.dev

Source: donicaqterrie.pages.dev

Hsa Contributions 2024 Ardys Winnah, For 2024, you can contribute up to $4,150 if you have. This rises to $3,200 in 2024.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

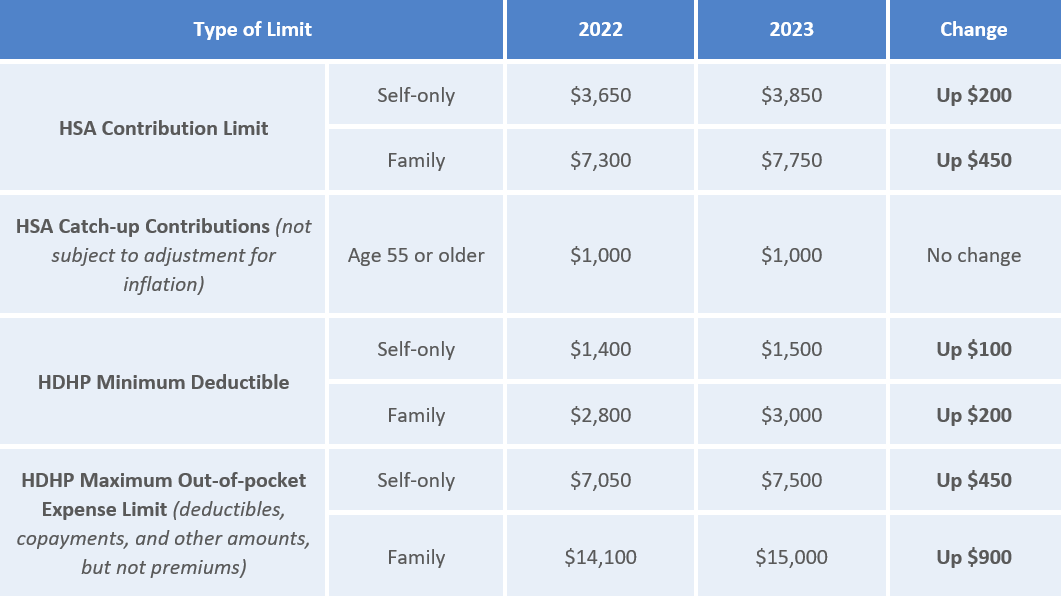

The Best Order of Operations For Saving For Retirement, For 2024, you can contribute up to $4,150 if you have. In 2024, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2023, which had limits of $3,850 and $7,750.

Source: www.hrmorning.com

Source: www.hrmorning.com

New 2024 FSA and HSA limits What HR needs to know HRMorning, But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). This rises to $3,200 in 2024.

Source: andyqkerrill.pages.dev

Source: andyqkerrill.pages.dev

Fsa 2024 Contribution Limits Clara Demetra, The hsa limits, which are indexed for inflation every year, will increase in 2024. In 2024, employees can contribute up to $3,200 to a health fsa.

Source: www.blueridgeriskpartners.com

Source: www.blueridgeriskpartners.com

HSA vs. FSA What's the Difference? Blue Ridge Risk Partners, What to know about the ‘significant increase,’ says advisor. But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: www.bccbenefitsolutions.com

Source: www.bccbenefitsolutions.com

HSA/HDHP Contribution Limits Increase for 2023, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. (people 55 and older can stash away an.

Source: www.wexinc.com

Source: www.wexinc.com

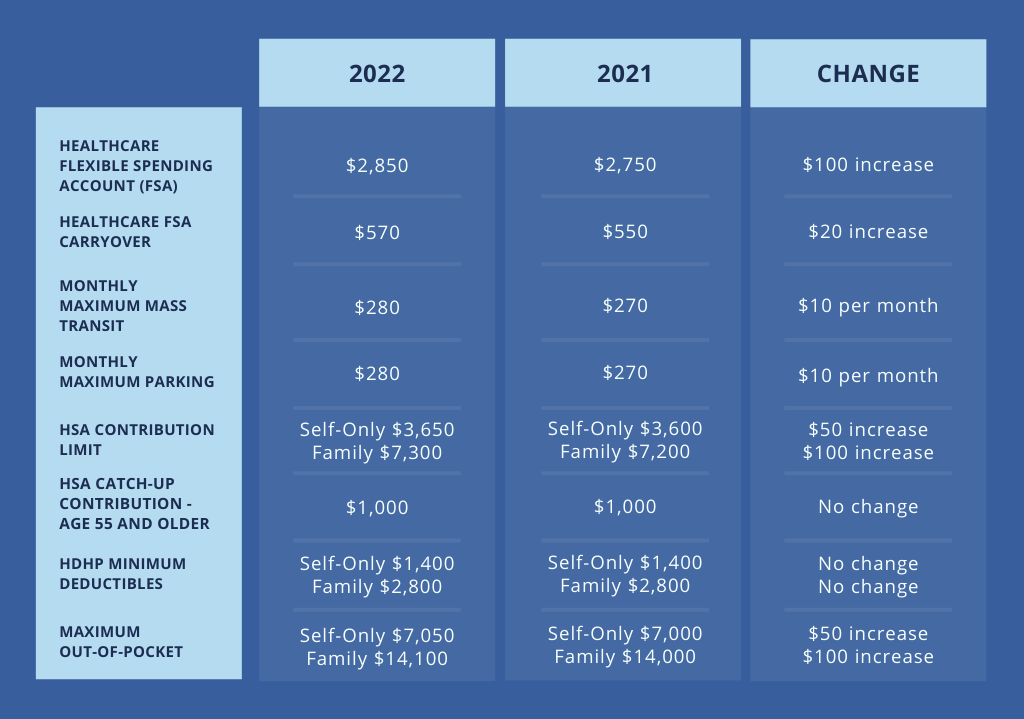

2023 FSA limits, commuter limits, and more are now available WEX Inc., The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. In 2024, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2023, which had limits of $3,850 and $7,750.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Fsa Limit For 2022 2022 JWG, On november 9th, 2023, the irs released rev. In 2024, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2023, which had limits of $3,850 and $7,750.

Source: rmcgp.com

Source: rmcgp.com

2022 Limits for FSA, HSA, and Commuter Benefits RMC Group, For 2024, you can contribute up to $4,150 if you have. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year.

For 2024, You Can Contribute Up To $4,150 If You Have.

For 2024, there is a $150 increase to the contribution limit for these accounts.

If Your Employer Contributes To Your Hsa Or Fsa On Your Behalf, This May Impact.

In 2024, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2023, which had limits of $3,850 and $7,750.